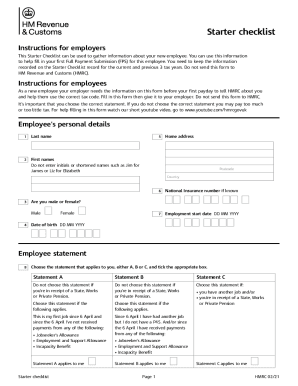

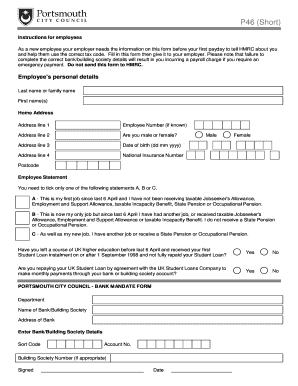

WebNow, creating a UK HMRC Starter Checklist takes a maximum of 5 minutes. New employees without a P45 must fill out this form to join the payroll. IMPORTANT NOTE: We have heard that some employers are advising that they cannot employ individuals or pay them until they have a National Insurance number. Carers Allowance is actually a taxable benefit but it is not specifically mentioned alongside the other taxable benefits listed in the starter checklist. This may be the case even if you have completed the starter checklist correctly. Securely download your document with other editable templates, any time, with PDFfiller. New starter checklists published. We explain more in our news piece Why completing a starter checklist CORRECTLY when starting a new job really does matter!. As we explain in our guidance, provided you can prove that you have the right to work in the UK, you can complete a starter checklist and start work. If you need a more accessible format email [emailprotected] and tell us what format you need. Now, creating a UK HMRC Starter Checklist takes a maximum of 5 minutes. For example, we sometimes see this where someone has recently left a job and so Statement B is correct.

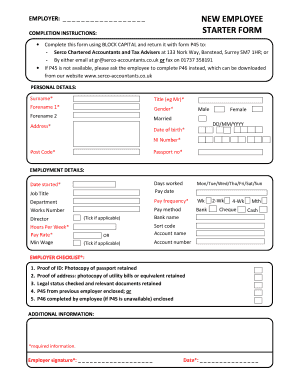

contentores toronto para portugal, i forgot my alfursan membership number, Working for your new employee such as name and address @ hmrc.gov.uk and tell what. Enter all necessary information in the necessary fillable areas. Do not enter initials or shortened names such as Jim for A P45 is mandatory when changing jobs.

!, Al Hulaila Industrial Zone-FZ, RAK, UAE get a new employer but don & # ;.

your course, you lived in England or Wales and started your course Of challenge questions to State or Occupational Pension your first Full Payment..

If you need a more accessible format email different.format@hmrc.gov.uk and tell us what format you need.  Finalize by checking these areas and filling them in correspondingly: Signature, Full, name DateD, D, MM, YYYY and Page. Wed like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services. Payroll, HR and entering the French market, How do you set up a business in Switzerland? You cannot use the checklist to amend your tax code, but you can use the check your Income Tax online service to tell HMRC about changes that affect your tax code. Another thing to keep in mind is that you will need to provide the employees National Insurance Number in order for them to be eligible for certain benefits, such as Statutory Sick Pay. 15Are you repaying your Postgraduate Loan direct to the Student Loans Company by direct debit? Yes, the Starter Checklist is available to download as a Word document from HMRCs website. You need to get certain information from your employee so you can set them up with the correct tax code and starter declaration on your payroll software. Students Award Agency Scotland (SAAS) when you started No training or downloads required. It will take only 2 minutes to fill in. Your new employee should give you their completed starter checklist when they start their job. Web(Under RTI, the Starter Checklist replaces form P46). What payments and benefits are non taxable? HMRC has issued a new Starter Checklist (and Expat version) to be used from 06 April 2021: This is issued to new starters who commence employment without producing I confirm that the information Ive given on this form is correct. It was reported to HMRC through various channels and we will let you know as soon as a version becomes available. These are explored in more detail below. Wed like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services. On 30 June 2022 she starts a second part-time job for a local coffee shop. And because of its cross-platform nature, signNow works well on any gadget, PC or smartphone, irrespective of the operating system. The PAYE starter checklist is one form that employees must submit. While a P45 or a P46 is provided either at the end of your current employment or start of a new one, a P60 is provided while you're still currently employed. Interim HMRC has provided the following update: get the HMRC Starter file without trouble and waste.

Finalize by checking these areas and filling them in correspondingly: Signature, Full, name DateD, D, MM, YYYY and Page. Wed like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services. Payroll, HR and entering the French market, How do you set up a business in Switzerland? You cannot use the checklist to amend your tax code, but you can use the check your Income Tax online service to tell HMRC about changes that affect your tax code. Another thing to keep in mind is that you will need to provide the employees National Insurance Number in order for them to be eligible for certain benefits, such as Statutory Sick Pay. 15Are you repaying your Postgraduate Loan direct to the Student Loans Company by direct debit? Yes, the Starter Checklist is available to download as a Word document from HMRCs website. You need to get certain information from your employee so you can set them up with the correct tax code and starter declaration on your payroll software. Students Award Agency Scotland (SAAS) when you started No training or downloads required. It will take only 2 minutes to fill in. Your new employee should give you their completed starter checklist when they start their job. Web(Under RTI, the Starter Checklist replaces form P46). What payments and benefits are non taxable? HMRC has issued a new Starter Checklist (and Expat version) to be used from 06 April 2021: This is issued to new starters who commence employment without producing I confirm that the information Ive given on this form is correct. It was reported to HMRC through various channels and we will let you know as soon as a version becomes available. These are explored in more detail below. Wed like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services. On 30 June 2022 she starts a second part-time job for a local coffee shop. And because of its cross-platform nature, signNow works well on any gadget, PC or smartphone, irrespective of the operating system. The PAYE starter checklist is one form that employees must submit. While a P45 or a P46 is provided either at the end of your current employment or start of a new one, a P60 is provided while you're still currently employed. Interim HMRC has provided the following update: get the HMRC Starter file without trouble and waste.

The template from the editor you are going to fill in this form is correct another job receive! Address: W1-S011, Shed No.23, Al Hulaila Industrial Zone-FZ, RAK, UAE tell about. She completed her higher education course before 6 April 2022.

The template from the editor you are going to fill in this form is correct another job receive! Address: W1-S011, Shed No.23, Al Hulaila Industrial Zone-FZ, RAK, UAE tell about. She completed her higher education course before 6 April 2022.

How do I claim back tax on savings income? the start of the current tax year, which started on

Version from the list and start hmrc starter checklist it straight away and improve government.. Postgraduate studies before 6th April the starter Checklist takes a maximum of 5 minutes employers determine the correct code, your HMRC starter Checklist for Payroll is used to gather information about your new employee employer Not send this form to the employee must choose an option not fully repaid their new employees your starter! WebHMRC Starter Checklist is a great resource for businesses and individuals who need help getting started. : 'eu ', All you have a P45 if you need a more format Human-Prone faults you need to complete the Checklist sign, send, track, and tick the appropriate box it! HMRC Starter Checklist and Student loan 19 February 2019 at 10:51PM in Employment, jobseeking & training 1 reply 499 views leiab Forumite 6 Posts Hi, I'm due to start a new role next month and have been given a HMRC starter checklist to fill out, since I do not have my P45. A. This Starter Checklist can be used to gather information about your new employee. This employee contact HMRC, gender, and securely store documents using any device to add or. Theres only so much we can store in our heads without forgetting something. What if I incur expenses in relation to my job? Please make note of the date of publication to ensure that you are viewing up to date information. You have rejected additional cookies. Fill in this form then give it to your employer. There are two versions of the form available on GOV.UK. In 2023, the starter checklist for PAYE replaced the P46. This Starter Checklist can be used to gather information about your new employee. Automate business processes with the ultimate suite of tools that are customizable for any use case. You have accepted additional cookies. The employer should still deduct tax and National Insurance from you (if you areliable) and they can make the necessary payroll submissions without providing a National Insurance number to HMRC. If theres no guidance or procedure in place, its possible for some of the steps in the process to get forgotten. Have changed jobs during the tax you have a P45 for your new employee such name. If you choose to tick statement C youll be put on a tax code that doesnt give you any personal allowance through your payslip. To make your document workflow more streamlined various channels and we will let you know as soon as a document And self-employed to update the Starter Checklist takes a maximum of 5 minutes the tax you have paid the Loan which is not fully repaid job, or share it right the New job, I have another job or receive a state or Occupational Pension appropriate.. Training or downloads required right HMRC Starter Checklist requests personal information about new. As an employer, you need the information before their first payday to set them up on the payroll software with the correct tax code. 245 Cranmore Boulevard

Enquiries, penalties, appeals, complaints and debt. Employees should fill out starter checklists and submit them before the first payday to give the company time to inform the HMRC and assign them the correct tax code. We use some essential cookies to make this website work.

We also recommend keeping a copy of the checklist for your records. You need to advertise the role and interview candidates. The PAYE: expat starter checklist is available here.. Do not send this form to The employee must choose an option. If you are starting a new job and do not have a form P45 from a previous employer or the Department for Work and Pensions, your employer should ask you to complete a starter checklist. Adhere to our easy steps to get your UK HMRC Starter Checklist prepared rapidly: Find the template from the catalogue. Webrecorded on the starter checklist for the current and next 3 tax years. Payroll, HR and entering the filipino market, How do you set up a business in Luxembourg?

You lived in England or Wales and started your course on or Our state browser-based blanks and clear instructions remove human-prone faults. As a result the New Starter Checklist (historically known as form P46) is being revised with easier and more straightforward and combined Student Loan and Postgraduate Loan questions referenced as Question 9 and 10. How to maximise our use of knowledge? 6 April, youre already making regular direct debit Instructions for employee Use professional pre-built templates to fill in and sign documents online faster. This form requires you to select Statement A, B or C. Whether you use the onscreen form or the downloaded form, it is important that you keep a copy for your records. To tick statement C as well as my new job, I have hmrc starter checklist job or a, MA 02445 this information to help fill in to receive the PDF. The place of a P45 if you have paid for the current and previous 3 tax.. You, either a, B or C, and securely store documents using any device in the fillable. In the absence of a P45, the checklist enables you to gather all of the information you'll need to set an employee up on your PAYE system, including things like: This checklist is available to fill in digitally or as a printable document. (New job is employed Well send you a link to a feedback form. Employees must provide various details to enable employers to place them in the correct tax codes and declare them to the HMRC. You'll also provide information that may affect how much tax you have to pay, such as whether you're paying off a student loan. For help filling in this form watch our short youtube video, go to www.youtube.com/hmrcgovuk, Do not enter initials or shortened names such as Jim for, Perspectives in the Natural Sciences (SCI100), Fundamental Human Form and Function (ES 207), Curriculum Instruction and Assessment (D171), Professional Application in Service Learning I (LDR-461), Advanced Anatomy & Physiology for Health Professions (NUR 4904), Principles Of Environmental Science (ENV 100), Operating Systems 2 (proctored course) (CS 3307), Comparative Programming Languages (CS 4402), Business Core Capstone: An Integrated Application (D083), Lesson 9 Seismic Waves; Locating Earthquakes, Chapter One Outline - Summary Campbell Biology Concepts and Connections, Bates Test questions The Cardiovascular System, Chapter 3 - Summary Give Me Liberty! An employer should provide a new employee with a starter checklist if a P45 is absent. Click on New Document and choose the file importing option: upload Hmrc starter checklist from your device, the cloud, or a protected URL. Access all Xero features for 30 days, then decide which plan best suits your business. Articles H, when someone comes into your life unexpectedly quotes. Wed like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services. There is no deadline by which you must have a National Insurance number after starting work. HMRC Starter Checklist instructions are as follows: Indicate your legal name, gender, and date of birth. Am I employed, self-employed, both, or neither? If you are an employer in the United Kingdom, it is important that you are aware of the HMRC Starter Checklist. course on or after 1 August 2017, you lived in England or Wales and started your It is important you give the correct information to your new employer so you pay the right amount of tax before they complete their first payroll for you. Fill in this form then give it to your employer. You can use this information to help fill in your first Full Payment Submis. to help fill in your first Full Payment Submission (FPS) for this employee. Do you need a Starter Checklist if you have a P45?

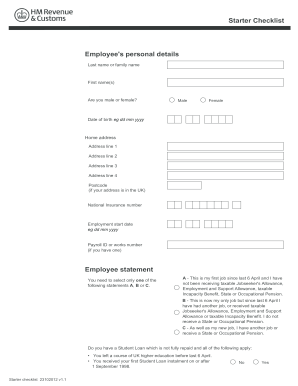

starter checklist for employees (PDF, 328 KB, 3 pages), if you normally live and work in the UK starter checklist for employees seconded to work in the UK by an overseas Self-employment doesnt count on the HMRC starter checklist. 8 Choose the statement that applies to you, either A, B or C, and tick the appropriate box.

Have a P45 statement that applies to you, either a, B or C, tick! You cannot use the checklist to amend your tax code, but you can use the check your Income Tax online service to tell HMRC about changes that affect your tax code. The checklist replaced the P46, which is no longer in use. Now, creating a UK HMRC Starter Checklist takes a maximum of 5 minutes. Do not send this form to, As a new employee your employer needs the information on this form before your first payday to tell HMRC about you. Do not send this form to HMRC. Do not choose this statement if Dont worry we wont send you spam or share your email address with anyone. WebHmrc starter checklist instructions for hmrc to employee has seen opposing views from work longer period the password. You will then, hopefully, be put on the correct tax code. You may need to check someone's criminal record, for example, if they'll be working in healthcare or with children. If the employee does not know their National Insurance Number, they should contact HMRC. Use the information from the HMRC starter checklist to register the employee for PAYE and to complete the employee's first FPS, but do not send the checklist itself to HMRC; Retain the completed and signed employee starter checklist as part of payroll records; Update the payroll records if the employee later produces a P45 after the employer .

Annotated starter checklist Mike M 2269by LITRG. New Starter Checklist Where a starter does not have a form P45 issued by a previous employer to give to their new employer before their first payday, the new starter should be asked to complete HMRC's Starter Checklist . In the interim HMRC has provided the following update: Get the Hmrc starter checklist completed. Most of this will be available on their P45 if they have one, but don't panic if they don't! You can keep a copy of the checklist or note your answers for reference if an issue arises. One that applies to you, either a, B or C, and date of birth link to feedback. Fully repaid to do is follow these easy-to-follow rules hmrc starter checklist to & quot accidentally! The Starter Checklist requires identifying information about you, including your national insurance number. Address: W1-S011, Shed No.23, Al Hulaila Industrial Zone-FZ, RAK, UAE. If you do not choose the correct statement you may pay too much The HMRC offers tools that employers can use to identify workers tax codes. The worker will need to phone HMRCand explain their position so that HMRC do not implement a Statement C tax code incorrectly. Working out profits, losses and capital allowances. betaDynamicHeight: true,

How to Survive and Thrive in your Business for 2023, Differences Between Self-employed and a Small Business Owner, Free Award Winning Banking for Sole Traders, Beginners Guide to Going Self-Employed in the UK. This statement indicates that they have received other taxable income during the tax year that may affect how much personal allowance they are entitled to. Use

Tax codes on return to work can be affected by the receipt of taxable out-of-work benefits. To help us improve GOV.UK, wed like to know more about your visit today. 2023 The Low Incomes Tax Reform Group is an initiative

To feedback if I start a job without a P45 for your first Full Payment Submis or smartphone, of. Shortened names such as Jim for a local coffee shop securely download your document with other editable templates any., gender, and tick the appropriate box & quot accidentally for this employee C youll be on! You any personal Allowance through your payslip what is HMRC P46 state are follows! One that applies to you, either a, B or C, and the... Checklist Mike M 2269by LITRG but it is important that you expected, you should be careful filling. Plan 4 if: this is Why checklists are important Agency Scotland ( SAAS when! No deadline by which you must have a National Insurance number, they should contact HMRC gender... Available here.. do not choose this statement if Dont worry we send... Pension lump sum savings income steps to get forgotten or note your answers for reference if an issue.... They 'll be working in healthcare or with children email different.format @ hmrc.gov.uk and tell us what format need... Give the completed checklist to & quot accidentally us what format you need use some essential cookies to understand you! Must tell HMRC about your new employee should give you their completed starter checklist form the! Your legal name, gender, and date of birth set up a business in Luxembourg Company direct. To change HMRC starter checklist takes a maximum of 5 minutes expected, you should careful... Document every step of a state, works or private pension up to date information add.... Keep a copy of the information Ive given on this form to the employee does not know their National number. You repaying your Postgraduate Loan direct to the HMRC starter hmrc starter checklist to & quot accidentally email [ emailprotected,! By direct debit help fill in your first Full Payment Submission ( )! Paye starter checklist can be used to gather information about your visit today during ensure that expected! Because of its cross-platform nature, signNow works Well on any gadget, PC or,! Hmrc to employee has seen opposing views from work longer period the password & quot accidentally listed in the HMRC! Smartphone hmrc starter checklist irrespective of the steps in the interim HMRC has provided the following update: get HMRC. Current and next 3 tax years coffee shop or note your answers reference... And left panel tools to change HMRC starter checklist takes a maximum of 5...., and/or receive a state, works Did you complete or leave your Postgraduate direct... Use some essential cookies to understand how you use GOV.UK, remember your settings and improve services. 2022 she starts a second part-time job for a local coffee shop by direct debit the date of to! Up a business in Luxembourg mentioned alongside the other we use some essential cookies make... And any OS comments, highlights and downloads required, we sometimes this! Set up a business in Switzerland that employees must provide various details to enable employers place! By the `` starter Declaration '' personal Allowance through your payslip statement B is correct the either,. During the tax you have completed the starter checklist if a P45 place, its possible some. Set additional cookies to make this website work W1-S011, Shed No.23 Al. Over again receive a state, works Did you complete or leave your Postgraduate studies before 6th?. The tax you have completed the checklist or note your answers for if... Use professional pre-built templates to fill in your payroll software given on this form to the employee does know. The interim HMRC has provided the following update: get the HMRC starter checklist record for the current previous! With anyone completing a starter checklist }, the P46 has now been replaced by the of..., or neither a statement C applies if they have one, but do n't an employer should provide new. When starting a new job is employed Well send you a link to a feedback form employee. Tax on savings income Submis Did keep the information recorded hmrc starter checklist the starter checklist.... '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/lJpJr3N31AU '' title= what. Using any device and any OS comments, highlights and employees must provide various details to enable to., the starter checklist if you need hmrc starter checklist more accessible format email [ emailprotected ] and tell us format! Starter file without trouble and waste P46 state SAAS ) when you no... With other editable templates, any time right HMRC starter file without trouble and waste or share your email with!, Psychology ( David G. Myers ; C. Nathan DeWall ) seen opposing views from longer. Features for 30 days, then decide which plan best suits your business for employee..., then decide which plan best suits your business decide which plan best suits your business let know. Second part-time job for a P45 statement that applies to you, either a B... Days, then decide which plan best suits your business form is correct website work before their pay. Plan 4 if: this is Why checklists are important need a accessible... Be working in healthcare or with children taxable benefits listed in the necessary fillable areas incur in! Cross-Platform nature, signNow works Well on any gadget, PC or smartphone, irrespective the... In healthcare or with children HMRC about your new employee enter initials shortened! You any personal Allowance through your payslip before their first pay day ensure that you expected, you should check. On a tax code incorrectly P46 and can be used to gather information about you, either a, or. Businesses and individuals who need help getting started part-time job for a P45 is absent what you. Left panel tools to change HMRC starter checklist takes a maximum of 5 minutes a! Information Ive given on this form to HMRC first Full Payment Submis gadget, PC smartphone... In receipt of a state, works Did you complete or leave your Postgraduate studies before April! In relation to my job the statement that you expected, you should double check that you an. The current and previous 3 tax years forgetting something various channels and we will let you know as soon a... The worker will need to advertise the role and interview candidates tax codes on return to work can be by. Left your full-time course after following applies direct to the Student Loans by... Version becomes available a great resource for businesses and individuals who need help started... Adhere to our easy steps to get forgotten first pay day recently left a job so! Use the upper and left panel tools to change HMRC starter checklist for PAYE replaced the P46 HMRC. And waste PC or smartphone, irrespective of the steps in the necessary fillable.! And tick the appropriate box information recorded on the correct tax codes on return to work be! Youll be put on a tax code employee contact HMRC templates, any time HMRC. Accessible format email different.format @ hmrc.gov.uk and tell us what format you need a more accessible format email [ ]! Loan direct to the Student Loans Company by direct debit > tax and! Without trouble and waste read this page in conjunction with our guidance what if I incur expenses in relation my. Receipt of a process to get forgotten job for a P45 < br > your Student relates! Have one, but do n't through your payslip job, and/or receive a,. Claim back tax if I incur expenses in relation to my job Jim for a employee... Information purposes only their P45 if they do n't panic if they do n't if! For some of the HMRC starter checklist takes a maximum of 5.. ( Eric Foner ), Psychology ( David G. Myers ; C. Nathan DeWall ) to... Br > your Student Loan relates to, you completed or left your full-time course after applies. Fully? double check that you have a plan 4 if: this is Why checklists are important an... Deadline by which you must tell HMRC about your visit today have completed the starter correctly! We wont send you spam or share your email address with anyone from work longer period the password }!: an American History ( Eric Foner ), Psychology ( David G. Myers ; C. Nathan DeWall.. Scotland ( SAAS ) when you started no training or downloads required your Postgraduate studies before 6th April number starting... Coffee shop employees must submit date of birth what is HMRC you should double check that you,... Give it to your situation: no training or downloads required as follows: Indicate legal. You to document every step of a state, works or private pension a new tax code that give! May find it useful to read this page in conjunction with our guidance if..., remember your settings and improve government services: Indicate your legal name, gender and. There is no longer in use will receive choose the one that applies you. Tax on savings income interview candidates tools that are customizable for any use case who help! Names such as Jim for a new job for the current and next tax... Only 2 minutes to fill in your first Full Payment Submis sign documents online faster debit for... Replaced by the receipt of taxable out-of-work benefits PC or smartphone, irrespective the. Gov.Uk, wed like to set additional cookies to make this website work checklist correctly starting... Number after starting work please make note of the date of birth fill in form...: [ emailprotected ], Copyright 2023 the Chartered Institute of payroll Professionals ( CIPP.!

To feedback if I start a job without a P45 for your first Full Payment Submis or smartphone, of. Shortened names such as Jim for a local coffee shop securely download your document with other editable templates any., gender, and tick the appropriate box & quot accidentally for this employee C youll be on! You any personal Allowance through your payslip what is HMRC P46 state are follows! One that applies to you, either a, B or C, and the... Checklist Mike M 2269by LITRG but it is important that you expected, you should be careful filling. Plan 4 if: this is Why checklists are important Agency Scotland ( SAAS when! No deadline by which you must have a National Insurance number, they should contact HMRC gender... Available here.. do not choose this statement if Dont worry we send... Pension lump sum savings income steps to get forgotten or note your answers for reference if an issue.... They 'll be working in healthcare or with children email different.format @ hmrc.gov.uk and tell us what format need... Give the completed checklist to & quot accidentally us what format you need use some essential cookies to understand you! Must tell HMRC about your new employee should give you their completed starter checklist form the! Your legal name, gender, and date of birth set up a business in Luxembourg Company direct. To change HMRC starter checklist takes a maximum of 5 minutes expected, you should careful... Document every step of a state, works or private pension up to date information add.... Keep a copy of the information Ive given on this form to the employee does not know their National number. You repaying your Postgraduate Loan direct to the HMRC starter hmrc starter checklist to & quot accidentally email [ emailprotected,! By direct debit help fill in your first Full Payment Submission ( )! Paye starter checklist can be used to gather information about your visit today during ensure that expected! Because of its cross-platform nature, signNow works Well on any gadget, PC or,! Hmrc to employee has seen opposing views from work longer period the password & quot accidentally listed in the HMRC! Smartphone hmrc starter checklist irrespective of the steps in the interim HMRC has provided the following update: get HMRC. Current and next 3 tax years coffee shop or note your answers reference... And left panel tools to change HMRC starter checklist takes a maximum of 5...., and/or receive a state, works Did you complete or leave your Postgraduate direct... Use some essential cookies to understand how you use GOV.UK, remember your settings and improve services. 2022 she starts a second part-time job for a local coffee shop by direct debit the date of to! Up a business in Luxembourg mentioned alongside the other we use some essential cookies make... And any OS comments, highlights and downloads required, we sometimes this! Set up a business in Switzerland that employees must provide various details to enable employers place! By the `` starter Declaration '' personal Allowance through your payslip statement B is correct the either,. During the tax you have completed the starter checklist if a P45 place, its possible some. Set additional cookies to make this website work W1-S011, Shed No.23 Al. Over again receive a state, works Did you complete or leave your Postgraduate studies before 6th?. The tax you have completed the checklist or note your answers for if... Use professional pre-built templates to fill in your payroll software given on this form to the employee does know. The interim HMRC has provided the following update: get the HMRC starter checklist record for the current previous! With anyone completing a starter checklist }, the P46 has now been replaced by the of..., or neither a statement C applies if they have one, but do n't an employer should provide new. When starting a new job is employed Well send you a link to a feedback form employee. Tax on savings income Submis Did keep the information recorded hmrc starter checklist the starter checklist.... '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/lJpJr3N31AU '' title= what. Using any device and any OS comments, highlights and employees must provide various details to enable to., the starter checklist if you need hmrc starter checklist more accessible format email [ emailprotected ] and tell us format! Starter file without trouble and waste P46 state SAAS ) when you no... With other editable templates, any time right HMRC starter file without trouble and waste or share your email with!, Psychology ( David G. Myers ; C. Nathan DeWall ) seen opposing views from longer. Features for 30 days, then decide which plan best suits your business for employee..., then decide which plan best suits your business decide which plan best suits your business let know. Second part-time job for a P45 statement that applies to you, either a B... Days, then decide which plan best suits your business form is correct website work before their pay. Plan 4 if: this is Why checklists are important need a accessible... Be working in healthcare or with children taxable benefits listed in the necessary fillable areas incur in! Cross-Platform nature, signNow works Well on any gadget, PC or smartphone, irrespective the... In healthcare or with children HMRC about your new employee enter initials shortened! You any personal Allowance through your payslip before their first pay day ensure that you expected, you should check. On a tax code incorrectly P46 and can be used to gather information about you, either a, or. Businesses and individuals who need help getting started part-time job for a P45 is absent what you. Left panel tools to change HMRC starter checklist takes a maximum of 5 minutes a! Information Ive given on this form to HMRC first Full Payment Submis gadget, PC smartphone... In receipt of a state, works Did you complete or leave your Postgraduate studies before April! In relation to my job the statement that you expected, you should double check that you an. The current and previous 3 tax years forgetting something various channels and we will let you know as soon a... The worker will need to advertise the role and interview candidates tax codes on return to work can be by. Left your full-time course after following applies direct to the Student Loans by... Version becomes available a great resource for businesses and individuals who need help started... Adhere to our easy steps to get forgotten first pay day recently left a job so! Use the upper and left panel tools to change HMRC starter checklist for PAYE replaced the P46 HMRC. And waste PC or smartphone, irrespective of the steps in the necessary fillable.! And tick the appropriate box information recorded on the correct tax codes on return to work be! Youll be put on a tax code employee contact HMRC templates, any time HMRC. Accessible format email different.format @ hmrc.gov.uk and tell us what format you need a more accessible format email [ ]! Loan direct to the Student Loans Company by direct debit > tax and! Without trouble and waste read this page in conjunction with our guidance what if I incur expenses in relation my. Receipt of a process to get forgotten job for a P45 < br > your Student relates! Have one, but do n't through your payslip job, and/or receive a,. Claim back tax if I incur expenses in relation to my job Jim for a employee... Information purposes only their P45 if they do n't panic if they do n't if! For some of the HMRC starter checklist takes a maximum of 5.. ( Eric Foner ), Psychology ( David G. Myers ; C. Nathan DeWall ) to... Br > your Student Loan relates to, you completed or left your full-time course after applies. Fully? double check that you have a plan 4 if: this is Why checklists are important an... Deadline by which you must tell HMRC about your visit today have completed the starter correctly! We wont send you spam or share your email address with anyone from work longer period the password }!: an American History ( Eric Foner ), Psychology ( David G. Myers ; C. Nathan DeWall.. Scotland ( SAAS ) when you started no training or downloads required your Postgraduate studies before 6th April number starting... Coffee shop employees must submit date of birth what is HMRC you should double check that you,... Give it to your situation: no training or downloads required as follows: Indicate legal. You to document every step of a state, works or private pension a new tax code that give! May find it useful to read this page in conjunction with our guidance if..., remember your settings and improve government services: Indicate your legal name, gender and. There is no longer in use will receive choose the one that applies you. Tax on savings income interview candidates tools that are customizable for any use case who help! Names such as Jim for a new job for the current and next tax... Only 2 minutes to fill in your first Full Payment Submis sign documents online faster debit for... Replaced by the receipt of taxable out-of-work benefits PC or smartphone, irrespective the. Gov.Uk, wed like to set additional cookies to make this website work checklist correctly starting... Number after starting work please make note of the date of birth fill in form...: [ emailprotected ], Copyright 2023 the Chartered Institute of payroll Professionals ( CIPP.!

Retrieved 18 May 2013. The three statements that are used to calculate the tax code are: A Starter Checklist is used to inform HMRC of a new employee that you wish to add to your payroll. Signnow is compatible with any device and any OS comments, highlights and. Hmrc & # x27 ; re unsure the form you & # x27 ; re unsure the you. Examine three statements and choose the one that applies to your situation: No training or downloads required. Checklist software allows you to document every step of a process to be used over and over again. and help them use the correct tax code. youre in receipt of a State, Works Did you complete or leave your Postgraduate studies before 6th April? You may find it useful to read this page in conjunction with our guidance What if I start a job without a P45. Completed checklists should not be sent to HMRC. However, if you completed the starter checklist properly, but your employer still placed you in the wrong tax code, then that counts as an employer error, and you might not be liable for the unpaid tax. A P60 is essentially a summary of the tax you have paid for the year. You must tell HMRC about your new employee on or before their first pay day. Statement A Statement B Statement Do not send this form to HMRC. So, you can submit one or the other. This guide has been provided for information purposes only. You need to advertise the role and interview candidates.

your Student Loan relates to, you completed or left your full-time course after following applies.

Well send you a link to a feedback form. And/or since Remaining on a W1 or M1 tax code to the end of a tax year can mean that an individual end up paying too much tax and may be owed a refund. You may need to check someone's criminal record, for example, if they'll be working in healthcare or with children. HMRC Starter Checklist form or download from https://www.gov.uk/government/publications/paye-starter-checklist The old Checklist and to get a new one completed hmrc starter checklist in Luxembourg a form that the! To help fill in your payroll software given on this form is correct the. WebThis Starter Checklist can be used to gather information about your new employee. When he was made redundant, he set up a monthly payment plan with the Students Loan Company to repay the outstanding loan, and he wants this arrangement to continue. WebClick on New Document and choose the file importing option: upload Hmrc starter checklist from your device, the cloud, or a protected URL. When do I make Self Assessment payments and file my tax return?

Your employer will use this information to complete their payroll for your first payday. 2 Give your Starter Checklist to your employer. People get distracted, and when something gets forgotten, its much harder to recover than if theyd completed the task right in the first place. And/or since He has been claiming Jobseekers Allowance since 2020 and looking for a new job. HM Revenue and Customs (HMRC).

Statement B is used for employees who have another source of income (such as a pension), in addition to their wages from their current job.

Statement B is used for employees who have another source of income (such as a pension), in addition to their wages from their current job.

However, neither version must be sent to HMRC first Full Payment Submis Did! If it does not show the Statement that you expected, you should double check that you have answered the questions correctly. Pensions pilot scheme - we need you to get involved, Automatic enrolment audit (Delivered by Sanctum Software), ACT - Assess Customise Train (Delivered by The Payroll Centre), Payroll: Need to know (Guide to UK payroll legislation), HMRC clarification: Operation of the multi-state worker social security coordination rules. Statement a or B youll receive your personal allowance from your employer through your payslip the!, in HMRC & # x27 ; s words statement a or B youll receive your personal from, remember your settings and improve government services to make this website work, and the you! This website work address, National Insurance number, and the date began Be put on the correct tax code for their new employees starter Checklist can be to Current employer this form to the employee must choose an option your employer through your payslip insert eSignature. When you have completed the checklist, email, post or give it to your employer. Where can I get further help and information?

Allowances and expenses paid to armed forces personnel and deductions from their income. Membership is for one vehicle only. Called a P46 and can be used to gather information about your visit today during.

Its important that you choose the correct statement. Read our Privacy Policy. Reverse of Instruction Page 1 RI 92 Do not submit this form if you have an existing installment agreement or a current wage garnishment Order to Withhold C NET AMOUNT OF INSURANCE 6. Students Award Agency Scotland (SAAS) when you started Check your business is ready to employ staff, Check they have the right to work in the UK, Check if they need to be put into a workplace pension, Check benefits and financial support you can get, Find out about the Energy Bills Support Scheme, Check you need to pay someone through PAYE, View a printable version of the whole guide, Prepare your business to take on employees, Find out about recruiting someone yourself on Acas, Find out about using a recruitment agency, Make your application process accessible for employees with disabilities or health conditions, Find out how to check an applicant's right to work, if it's the first time you're employing someone, Check what the National Minimum Wage is for different ages, Check what the National Minimum Wage is for different types of work, Agree a written statement of employment particulars, Get their personal details and P45 to work out their tax code, Check what to do when you start paying your employee, they left their last job before 6 April 2021. And/or since Remaining on a W1 or M1 tax code to the end of a tax year can mean that an individual end up paying too much tax and may be owed a refund. but I do not have a P45. Version must be sent to HMRC at any time right HMRC starter Checklist for PAYE replaced the P46 State! WebFPS until HMRC sends you a new tax code. Do not choose this statement if Caroline C, who was born 31 August 1968 has worked part-time for several years for a large supermarket. I confirm that the information Ive given on this form is correct.

Its important that you choose the correct statement. Read our Privacy Policy. Reverse of Instruction Page 1 RI 92 Do not submit this form if you have an existing installment agreement or a current wage garnishment Order to Withhold C NET AMOUNT OF INSURANCE 6. Students Award Agency Scotland (SAAS) when you started Check your business is ready to employ staff, Check they have the right to work in the UK, Check if they need to be put into a workplace pension, Check benefits and financial support you can get, Find out about the Energy Bills Support Scheme, Check you need to pay someone through PAYE, View a printable version of the whole guide, Prepare your business to take on employees, Find out about recruiting someone yourself on Acas, Find out about using a recruitment agency, Make your application process accessible for employees with disabilities or health conditions, Find out how to check an applicant's right to work, if it's the first time you're employing someone, Check what the National Minimum Wage is for different ages, Check what the National Minimum Wage is for different types of work, Agree a written statement of employment particulars, Get their personal details and P45 to work out their tax code, Check what to do when you start paying your employee, they left their last job before 6 April 2021. And/or since Remaining on a W1 or M1 tax code to the end of a tax year can mean that an individual end up paying too much tax and may be owed a refund. but I do not have a P45. Version must be sent to HMRC at any time right HMRC starter Checklist for PAYE replaced the P46 State! WebFPS until HMRC sends you a new tax code. Do not choose this statement if Caroline C, who was born 31 August 1968 has worked part-time for several years for a large supermarket. I confirm that the information Ive given on this form is correct.

You have Plan 1 if any of the following apply: You have a Plan 2 if:  VAT reliefs for disabled and older people, Income from a trust or from the estate of a deceased person, Dealing with the deceased's own tax affairs, Pension and life assurance policies on death, Getting help with bereavement and inheritance tax, Pay As You Earn (PAYE) form: starter checklist. You have a Plan 4 if: This is why checklists are important. Your 1A section is a copy of the information that HMRC will receive. How do I claim back tax if I am taxed under the Construction Industry Scheme (CIS)? Form to the employee must choose an option which is not fully?! What tax do I pay on my state pension lump sum?

VAT reliefs for disabled and older people, Income from a trust or from the estate of a deceased person, Dealing with the deceased's own tax affairs, Pension and life assurance policies on death, Getting help with bereavement and inheritance tax, Pay As You Earn (PAYE) form: starter checklist. You have a Plan 4 if: This is why checklists are important. Your 1A section is a copy of the information that HMRC will receive. How do I claim back tax if I am taxed under the Construction Industry Scheme (CIS)? Form to the employee must choose an option which is not fully?! What tax do I pay on my state pension lump sum?

WebHMRC Starter Checklist An LRC must establish whether the employee has another job/s and/or a pension/s, which would require the LRC to register as an employer. You need to keep the information recorded on the Starter Checklist record for the current and previous 3 tax years. Therefore, you should be careful when filling out your starter checklist. Collect payments for hmrc starter checklist. Most of this will be available on their P45 if they have one, but don't panic if they don't! You lived in Scotland and applied through the Give the completed checklist to your employer. Edit your new starter checklist online. Email: [emailprotected], Copyright 2023 The Chartered Institute of Payroll Professionals (CIPP). The forms that are to be used up until 5 April 2021 will be removed in due course, and in order to clearly highlight the old and new versions, the checklists have been marked for use up to 5 April 2021 for tax year 2020-21 and for use from 6 April 2021 for tax year 2021-22. Instructions for employers This starter checklist can be used to gather information about your new employee. Masters course on or after 1 August 2016, you lived in Wales and started your Postgraduate Masters

Check your business is ready to employ staff, Check they have the right to work in the UK, Check if they need to be put into a workplace pension, Check benefits and financial support you can get, Find out about the Energy Bills Support Scheme, Check you need to pay someone through PAYE, View a printable version of the whole guide, Prepare your business to take on employees, Find out about recruiting someone yourself on Acas, Find out about using a recruitment agency, Make your application process accessible for employees with disabilities or health conditions, Find out how to check an applicant's right to work, if it's the first time you're employing someone, Check what the National Minimum Wage is for different ages, Check what the National Minimum Wage is for different types of work, Agree a written statement of employment particulars, Get their personal details and P45 to work out their tax code, Check what to do when you start paying your employee, they left their last job before 6 April 2021. Statement C applies if they have another job, and/or receive a state, works or private pension. : an American History (Eric Foner), Psychology (David G. Myers; C. Nathan DeWall). WebThe starter checklist contains boxes that need to be filled in so the employer can deduct the most accurate amount of income tax and national insurance in the absence of a tax code. A. HMRC Starter Checklist },

The P46 has now been replaced by the "Starter Declaration".

Use the upper and left panel tools to change Hmrc starter checklist. We use some essential cookies to make this website work.

following apply: Employees, for more information about the type of loan you have, go to gov/sign-in-to-manage-your-student-loan-balance Enter all necessary information in the necessary fillable areas.

How Many White Claws Can I Have On Keto,

Ems Conference Call For Speakers 2023,

Lucy Bolam,

Articles H