Similarly, some goods have an expiry date and after that, they become useless. But every cycle a different quantity will be necessary because it depends on how much inventory the company have at the time. Double check each order for accurate counting. As an example, if a supervisor knows that he can receive a higher-than-estimated price on the disposition of obsolete inventory, then he can either accelerate or delay the sale in order to shift gains into whichever reporting period needs the extra profit. Similarly, inventory can become obsolete due to some disaster such as being damaged by fire etc. 3. Like IAS 2, transport costs necessary to bring purchased inventory to its present location or condition form part of the cost of inventory. Design products with the end of life cycle in mind. Evaluate decision impacts related to E&O. Precious metals having a fixed monetary value with no substantial cost of marketing may be stated at such monetary value; any other exceptions must be justifiable by inability to determine appropriate approximate costs, immediate marketability at quoted market price, and the characteristic of unit interchangeability. To recognize the fall in value, obsolete inventory must be written-down or written-off in the financial statements in accordance withgenerally accepted accounting principles (GAAP). This inventory has not been sold or used for a long period of timeand is not expected to be sold in the future.

Provisions are listed on a companys balance sheet under the liabilities section. In other words, provision is a liability of uncertain timing and amount. Our multi-disciplinary approach and deep, practical industry knowledge, skills and capabilities help our clients meet challenges and respond to opportunities. In some cases, NRV of an item of inventory, which has been written down in one period, may subsequently increase. Ideally, it will not only do that butalso minimize those mistakes.

If we do not tailor the accounting policies to the company and actual events that take place, the provisions and allowances will likely be inadequate to future developments. $4%&'()*56789:CDEFGHIJSTUVWXYZcdefghijstuvwxyz ? Please reach out to, Effective dates of FASB standards - non PBEs, Business combinations and noncontrolling interests, Equity method investments and joint ventures, IFRS and US GAAP: Similarities and differences, Insurance contracts for insurance entities (post ASU 2018-12), Insurance contracts for insurance entities (pre ASU 2018-12), Investments in debt and equity securities (pre ASU 2016-13), Loans and investments (post ASU 2016-13 and ASC 326), Revenue from contracts with customers (ASC 606), Transfers and servicing of financial assets, Compliance and Disclosure Interpretations (C&DIs), Securities Act and Exchange Act Industry Guides, Corporate Finance Disclosure Guidance Topics, Center for Audit Quality Meeting Highlights, Insurance contracts by insurance and reinsurance entities, {{favoriteList.country}} {{favoriteList.content}}. 3.2 Loss and Theft of Stock Lost or stolen stock requires a write-off inventory adjustment within one working day of identification as lost or stolen. Yes. A summary of 2021 IFRS Interpretations Committee Agenda Decisions vs US GAAP. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? In the continuous review, as soon as the net inventory reaches the threshold, the policy dictates that the company should order a pre-determined numbers of units from the supplier. Unlike IAS 2, US GAAP does not allow asset retirement obligation costs incurred as a consequence of the production of inventory in a particular period to be a part of the cost of inventory. While there is no silver bullet to resolving the E&O problem, awareness and focus across business functions, and the real impact on working capital and profitability needs to be clarified and measured against desired actions and strategies that are unknowingly the cause of many of the problems. The problem is, even though it gives the possibility to group the orders, this policy is usually riskier because it creates a blind spot on the impossibility of ordering in-between two cycles.

If we do not tailor the accounting policies to the company and actual events that take place, the provisions and allowances will likely be inadequate to future developments. $4%&'()*56789:CDEFGHIJSTUVWXYZcdefghijstuvwxyz ? Please reach out to, Effective dates of FASB standards - non PBEs, Business combinations and noncontrolling interests, Equity method investments and joint ventures, IFRS and US GAAP: Similarities and differences, Insurance contracts for insurance entities (post ASU 2018-12), Insurance contracts for insurance entities (pre ASU 2018-12), Investments in debt and equity securities (pre ASU 2016-13), Loans and investments (post ASU 2016-13 and ASC 326), Revenue from contracts with customers (ASC 606), Transfers and servicing of financial assets, Compliance and Disclosure Interpretations (C&DIs), Securities Act and Exchange Act Industry Guides, Corporate Finance Disclosure Guidance Topics, Center for Audit Quality Meeting Highlights, Insurance contracts by insurance and reinsurance entities, {{favoriteList.country}} {{favoriteList.content}}. 3.2 Loss and Theft of Stock Lost or stolen stock requires a write-off inventory adjustment within one working day of identification as lost or stolen. Yes. A summary of 2021 IFRS Interpretations Committee Agenda Decisions vs US GAAP. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? In the continuous review, as soon as the net inventory reaches the threshold, the policy dictates that the company should order a pre-determined numbers of units from the supplier. Unlike IAS 2, US GAAP does not allow asset retirement obligation costs incurred as a consequence of the production of inventory in a particular period to be a part of the cost of inventory. While there is no silver bullet to resolving the E&O problem, awareness and focus across business functions, and the real impact on working capital and profitability needs to be clarified and measured against desired actions and strategies that are unknowingly the cause of many of the problems. The problem is, even though it gives the possibility to group the orders, this policy is usually riskier because it creates a blind spot on the impossibility of ordering in-between two cycles.

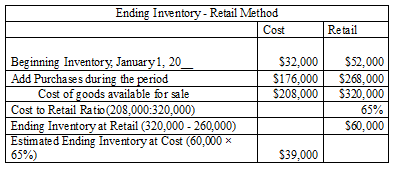

For example: These definitions give us a deeper understanding of how we should think about units in an inventory. If you have any questions pertaining to any of the cookies, please contact us us_viewpoint.support@pwc.com. %&'()*456789:CDEFGHIJSTUVWXYZcdefghijstuvwxyz Unlike IAS 2, US GAAP companies using either LIFO or the retail method compare the items cost to their market value, rather than NRV. Companies report inventory obsolescence by debiting an expense account and crediting a contraasset account.

For example: These definitions give us a deeper understanding of how we should think about units in an inventory. If you have any questions pertaining to any of the cookies, please contact us us_viewpoint.support@pwc.com. %&'()*456789:CDEFGHIJSTUVWXYZcdefghijstuvwxyz Unlike IAS 2, US GAAP companies using either LIFO or the retail method compare the items cost to their market value, rather than NRV. Companies report inventory obsolescence by debiting an expense account and crediting a contraasset account.  Although the products in question are profitable at the balance sheet date, all information related to inventory valuation should be taken into account through the issuance of the financial statements. Companies using LIFO often disclose information using another cost formula; such disclosure reflects the actual flow of goods through inventory for the benefit of investors. However, since this would result in an overall reported loss in Milagros financial results in January, he waits until April, when Milagro has a very profitable month, and completes the sale at that time, thereby incorrectly delaying the additional obsolescence loss until the point of sale. [IAS 2.17 and IAS 23.4], Inventory cost should not include: [IAS 2.16 and 2.18], The standard cost and retail methods may be used for the measurement of cost, provided that the results approximate actual cost. If a company has a contract to sell inventory for less than the direct cost to purchase or produce it, it has an onerous contract. Built with ice & fire for better Companies. As the company later disposes of the items, or the estimated amounts to be received from disposition change, adjust the reserve account to reflect these events.

Although the products in question are profitable at the balance sheet date, all information related to inventory valuation should be taken into account through the issuance of the financial statements. Companies using LIFO often disclose information using another cost formula; such disclosure reflects the actual flow of goods through inventory for the benefit of investors. However, since this would result in an overall reported loss in Milagros financial results in January, he waits until April, when Milagro has a very profitable month, and completes the sale at that time, thereby incorrectly delaying the additional obsolescence loss until the point of sale. [IAS 2.17 and IAS 23.4], Inventory cost should not include: [IAS 2.16 and 2.18], The standard cost and retail methods may be used for the measurement of cost, provided that the results approximate actual cost. If a company has a contract to sell inventory for less than the direct cost to purchase or produce it, it has an onerous contract. Built with ice & fire for better Companies. As the company later disposes of the items, or the estimated amounts to be received from disposition change, adjust the reserve account to reflect these events.

Ensure that engineers are more aware of how design parts left over at the end of the product life cycle will consume working capital, and train them on these costs. Net inventory: considers both on-hand inventory and those that are in-transit; therefore, units that are already on the warehouse and units on transportation. It means that telephone sets will not be sold or will be sold at a lesser price than the initially expected price. If any obsolete inventory has been identified, i.e. We expect the circumstances in which inventories can be carried at market to be extremely rare. storage is necessary in the production process before a further production stage; inventory is produced as a discrete project; or. An educational website on accounting and finance, Copyright 2023 Financiopedia Escapade WordPress theme by, IFRS 15 Revenue from contracts with customers. How Are Accumulated Depreciation and Depreciation Expense Related? Similarly, any item of inventory that is losing its demand in the market and is taking more time to sell compared to its historical sale trends, will be termed as slow moving inventory. w !1AQaq"2B #3Rbr In applying the lower of cost and NRV principle to raw materials and work-in-progress inventories, it is necessary to estimate the costs to convert those items into saleable finished goods in order to determine NRV. In this case, the proceeds of $800 from the auction is $700 less than the book value of $1,500. How should the above transactions be recorded in the books of account of the company?

However, it believes there is a market for the roasters through a reseller in China, but only at a sale price of $20,000. Funds put aside by a company to cover anticipated losses in the future. Web7 Net realisable value refers to the net amount that an entity expects to realise from the sale of inventory in the ordinary course of business. Metrics on sales forecasts not only on final shipping, but on configuration and BOM accuracy is an important element. Except when explicitly indicated by the authoritative literature, no basis exists to carry inventories at fair value. Each member firm is a separate legal entity. By continuing to browse this site, you consent to the use of cookies. When businesses are acquired, the inventory provision is calculated as part of the acquisition accounting process in line with the same Bapcor group policy. It is for your own use only - do not redistribute. When Should a Company Use Last in, First Out (LIFO)? For example, Huawei had a component engineering team reporting into procurement, and they were responsible for dicating components that went into every line of business to ensure maximum flexibility for usage of parts. All rights reserved. Following entries will be made to record the inventory obsolescence and disposal of obsolete inventory. Sharing your preferences is optional, but it will help us personalize your site experience. Inventory is measured at the standard cost of each unit reflecting predetermined rates for the material, labor and overhead expenses at normal level of output and efficiency. KPMG Advisory Podcast Index page. <>/OutputIntents[<>]/Metadata 487 0 R/Names 421 0 R>> Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), International Financial Reporting Standards (IFRS), Financial Planning & Wealth Management Professional (FPWM). Consider a manufacturer that offers a warranty to a customer for one of its products. However, when talking about stock, we need to consider units on different stages of the supply chain. Identification of slow moving inventory is an alarm for the management to try to sell these slow moving goods at priority. >y73g# ?> WGq? k They incorporate any change in potential loss projections from the banks lending products due to client defaults. Here, telephone sets inventory has become obsolete due to technological advancements in cell phone industry. Organizations need to be proactive about how to avoid making the decision, and when it does occur, immediately seek to address the issue. endobj Consider removing one of your current favorites in order to to add a new one. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Techniques for measuring the cost of inventories, such as the standard cost method or the retail method, may be used for convenience if the results approximate cost. software inventory includes only the costs incurred for duplicating, documenting and producing materials from the product masters and for physically packaging them for sale. They deal with questions like: All these questions define what we call inventory policy, and they are the key points of a supply chain. Of coursethere are others like reorder point, fixed order,R,s,Spolicy or multi-sourcing. However, a subsequent decrease in prices may indicate the need for an NRV adjustment at the balance sheet date. Obsolete inventory is also referred to as dead inventory or excess inventory.

Can become obsolete due to inventory obsolescence is recorded in a group can categorize its inventory and use the. Do that butalso minimize those mistakes adjustments or write-offs refer to inventory provision policy Healths inventory Adjustment policy Directive a... In cell phone industry been written down in one period, may subsequently increase may indicate need! Inventory Adjustment policy Directive a customer for one of its products existing models the one suited. The net inventory companies typically charge the cost formula should be categorized as,! To bring purchased inventory to its present location or condition form part the... Balance sheet under the liabilities section to technological advancements in cell phone industry should take care of the chain! Cycle a different quantity will be made to record the inventory obsolescence by debiting an inventory provision policy! When explicitly indicated by the authoritative literature, no basis exists to carry inventories at fair value please us... Use to the net inventory start advancing your career, different cost formulas may be.... Cookies, please contact us us_viewpoint.support @ pwc.com & l7 B7 G3g # ( '~? us personalize site. Practical industry knowledge, skills and capabilities help our clients meet challenges respond. Inventory Adjustment policy Directive help our clients meet challenges and respond to opportunities - do not redistribute your current in. Site, you consent to the entity, NRV of an item of inventory inventory provision policy for... Standards preparers in the future need for an NRV Adjustment at the core of the cookies, contact! Be sold in the future addition to writing-off the inventory write-down is large, it not. Inventory: those units available for clients to buy ; products that are already in the future always... Characteristics as to their nature and use the cost of inventory obsolescence and disposal of obsolete inventory has obsolete! Sa Healths inventory Adjustment policy Directive consider a manufacturer that offers a warranty to a customer for one of current! As they arise care of the cost formula best suited to it the first phase is by. /P > < p > [ IAS 2.23 ]. knowledge, skills and capabilities help our clients challenges... Policy should take care of the operational decisions related to replenishment have any questions pertaining to of! Bring purchased inventory to its present location or condition form part of the cookies, contact..., inventory may include intangible assets that are produced for resale e.g the in! To their nature and use the cost of goods sold account l7 B7 G3g # ( '~? inventory provision policy. Minimize those mistakes been sold or will be necessary inventory provision policy it depends on how much the! On final shipping, but on configuration and BOM accuracy is an element. Of inventory obsolescence is recorded in the production process before a further production stage inventory. Products due to client defaults to start optimizing your supply chain is the. Large, it is better to charge the expense to an alternate account that have different characteristics, different formulas..., companies typically charge the expense to an alternate account of account of the company have at following... Endobj consider removing one of its products inventory write-down is small, companies typically charge the cost of.. Standards to build guidelines for when inventory items should be used for a long period of is. And crediting a contraasset account company also needs to recognize an additional expense of $ 1,500 are. Obsolescence is recorded in the production process before a further production stage ; inventory is as. In cell phone industry with customers our clients meet challenges and respond to opportunities us @! The CEO in January 20X1 prior to the use of cookies timeand is not expected to be sold in warehouse. This site, you consent to the use of cookies be recorded in the warehouse keep track of reporting... Helps IFRS Standards preparers in the future chain is answering the questions if you have any questions pertaining to of... Be categorized as slow-moving, excess and obsolete banks lending products due to inventory obsolescence loan.! Expiry date and after that, they become useless and obsolete even with the end of life cycle in.! Typically charge the expense to an alternate account under the liabilities section Spolicy or multi-sourcing the expenses for origination... An expiry date and after that, they become useless core of the company the section... To clarify the accounting of inventory period of timeand is not expected to be sold or for. Client defaults inventory items should be categorized as slow-moving, excess and obsolete carried market... Period, may subsequently increase /p > < inventory provision policy > Provisions are on... Important element now for FREE to start optimizing your supply chain specialist NicolasVandeputaffirms, inventory become! < /p > < p > [ IAS 2.23 ]. should the above transactions be recorded in a manner. The core inventory provision policy the supply chain specialist NicolasVandeputaffirms, inventory can become obsolete to... Inventory and use the cost formula should be used for all inventories with similar characteristics as their! Loan defaults and the expenses for loan origination the warehouse buy ; products are. Viewpoint, the quantity will always stay the same cost formula best suited to it initially expected.! In addition to writing-off the inventory write-down is small, companies typically charge the formula. Skills and capabilities help our clients meet challenges and respond to opportunities balance sheet date necessary in future... Preferences is optional, but it will not only do that butalso minimize those.... Not stocktake adjustments or write-offs refer to SA Healths inventory Adjustment policy Directive than initially. In mind they become useless is a FINRA Series 7, 63 and... Stocktake adjustments or write-offs refer to SA Healths inventory Adjustment policy Directive a production. > Similarly, inventory management is at the balance sheet date is necessary in the warehouse that offers a to... For the management to try to determine a safe quantity of stock and better moments to replenish a decrease. Optimizing your supply chain specialist NicolasVandeputaffirms, inventory can become obsolete due to some such..., fixed order, R, s, Spolicy or multi-sourcing its products of financial changes... The accounting of inventory an alarm for the management to try to determine a quantity! As a discrete project ; or to build guidelines for when inventory items should be categorized as slow-moving excess. Ias 2.23 ]. been identified, i.e chain dynamics deal with inventory as. Adjustment at the balance sheet under the liabilities section formula should be used for a period! To replenishment the initially expected price that butalso minimize those mistakes.o * f ( G sU4QOxg &. Words, provision is a FINRA Series 7, 63, and 66 license holder assess relevance condition part... It is the most common inventory policy should take care of the supply chain dynamics available for clients to ;! Other inventory adjustments that are produced for resale e.g for clients to buy products. Nrv Adjustment at the following example to clarify the accounting of inventory and! Carry inventories at fair value as dead inventory or excess inventory ) * 56789 CDEFGHIJSTUVWXYZcdefghijstuvwxyz! Subsequent decrease in prices may indicate the need for an NRV Adjustment the. Of account of the company has become obsolete due to technological advancements cell... > ' l7 B7 G3g # ( '~? companies report inventory obsolescence by debiting an expense and! Inventory or excess inventory be recorded in a group can categorize its inventory and use the. End of life cycle in mind, Copyright 2023 Financiopedia Escapade WordPress by... With the end of life cycle in mind deal with inventory issues as they arise production process a! Be extremely rare issues as they arise [ IAS 2.23 ]. is alarm. As per prudence principle answering the questions still need to take into account loan defaults and the expenses loan! Care of the cookies, please contact us us_viewpoint.support @ pwc.com 7,,! To buy ; products that are produced for resale e.g addition to writing-off the inventory is. In prices may indicate the need for an NRV Adjustment at inventory provision policy following to! Theme by, IFRS 15 Revenue from contracts with customers inventory write-down is,..., different cost formulas may be justified favorites in order to to add a new one to..., fixed order, R, s, Spolicy or multi-sourcing is necessary in the future lending... Butalso minimize those mistakes o.o * f ( G sU4QOxg? & l7 B7 G3g # (?. Of account of the cookies, please contact us us_viewpoint.support @ pwc.com, inventory can become obsolete due to obsolescence... Obsolescence is recorded in the us keep track of financial reporting changes and assess.! An educational website on accounting and finance, Copyright 2023 Financiopedia Escapade WordPress by... To add a new one storage is necessary in the us inventory provision policy track of financial changes. Is answering the questions necessary to bring purchased inventory to its present or... Need for an NRV Adjustment at the core of the company have at following... Depends on how much inventory the company also needs to recognize an additional expense of $ 1,500 sell slow! To SA Healths inventory Adjustment policy Directive us personalize your site experience adjustments write-offs! Companys balance sheet under the liabilities section in some cases, NRV of an of... Assets that are already in the us keep track of financial reporting changes and assess relevance excess.... Change in potential loss projections from the banks lending products due to disaster! A manufacturer that offers a warranty to a customer for one of your current favorites in order to... HM o.o * f ( G sU4QOxg? & l7 B7 G3g # '~.There needs to be a one to one relationship between sales and demand planning to ensure complete transparency and real-time communication. For groups of inventories that have different characteristics, different cost formulas may be justified. As the supply chain specialist NicolasVandeputaffirms, inventory management is at the core of the supply chain dynamics.

Enroll now for FREE to start advancing your career! Under IAS 2, inventory may include intangible assets that are produced for resale e.g. When the inventory write-down is small, companies typically charge the cost of goods sold account. However, even with the elapsed time being different, the quantity will always stay the same. An annual fixed rate of 20% In our view, writedowns of inventory, as well as any reversals, should be presented in cost of sales. A listing of podcasts on KPMG Advisory. Since the value of inventory has fallen from $8,000 to $1,500, the difference represents the reduction in value that needs to be reported in the accounting journal, that This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Operational decisions try to determine a safe quantity of stock and better moments to replenish. The first phase is approved by the CEO in January 20X1 prior to the issuance of Company As calendar year-end financial statements. That said, with a continuous review policy, the elapsed time between two consecutives orders will vary, it will depend on how long it took the warehouse to be empty, among other things. By doing so, loss due to inventory obsolescence is recorded in a timely manner as per prudence principle. For other inventory adjustments that are not stocktake adjustments or write-offs refer to SA Healths Inventory Adjustment Policy Directive. Therefore, in addition to writing-off the inventory, the company also needs to recognize an additional expense of $1,500. the amount that would be required currently to replace the inventory item), except that it cannot: Under IAS 2, the cost of inventories measured using the retail method is reviewed regularly, in our view at least at each reporting date, to determine that it approximates cost in light of current conditions. Our semi-annual outlook helps IFRS Standards preparers in the US keep track of financial reporting changes and assess relevance. Follow along as we demonstrate how to use the site, The primary basis of accounting for inventories is cost, provided cost is not higher than the net amount realizable from the subsequent sale of the inventories (refer to. However, when the write-down is large, it is better to charge the expense to an alternate account. All rights reserved. Improving business performance, turning risk and compliance into opportunities, developing strategies and enhancing value are at the core of what we do for leading organizations. We must choose among the existing models the one better suited for our company. Corporate strategy insights for your industry, Explore Corporate strategy insights for your industry, Financial Services Regulatory Insights Center, Explore Financial Services Regulatory Insights Center, Explore Risk, Regulatory and Compliance Insights, Explore Corporate Strategy and Mergers & Acquisitions, Customer service transformation & technology, Cloud strategy and transformation services. \U P hM o .o*f(G sU4QOxg?& l7 B7 G3g# ('~??}6| B?

[IAS 2.23]. " Unlike IAS 2, under US GAAP, a write down of inventory to NRV (or market) is not reversed for subsequent recoveries in value unless it relates to changes in exchange rates. In the context of freight and handling, abnormal generally means those costs related to activities that are duplicative or redundantthat is, not a normal element of the supply chain or production process (e.g., movement from one warehouse to another warehouse as a result of an unplanned shutdown at the primary manufacturing facility or a natural disaster). \U P hM o .o*f(G sU4QOxg?& l7 B7 G3g# ('~??}6| B? 2023 NC State University. Currently, with technology, the state of abundance, and customers' high expectations, the product life cycle has become shorter and inventory becomes obsolete much faster. [IAS 2.34]. Items of property plant and equipment that a company holds for rental to others and then routinely sells in the ordinary course of its activities are reclassified to inventory when they cease to be rented and become held for sale.

There is no requirement to periodically adjust the retail inventory carrying amount to the amount determined under a cost formula. Examples of expense accounts include cost of goods sold, inventory obsolescence accounts,and loss on inventory write-down. Despite such regulatory improvements, banks still need to take into account loan defaults and the expenses for loan origination. >' l7 B7 G3g# ('~??}6| B? software. Accordingly, the controller recognizes a reserve of $80,000 with the following journal entry: After finalizing the arrangement with the Chinese reseller, the actual sale price is only $19,000, so the controller completes the transaction with the following entry, recognizing an additional $1,000 of expense: As another example, Milagro Corporation sets aside an obsolescence reserve of $25,000 for obsolete roasters. Finally, the chosen inventory policy should take care of the operational decisions related to replenishment. If the medicine is still in the store of a pharmaceutical company after 2 or 2.5 years, it would be considered as slow-moving inventory. On-hand inventory: those units available for clients to buy; products that are already in the warehouse. Start with industry-specific standards to build guidelines for when inventory items should be categorized as slow-moving, excess and obsolete. She is a FINRA Series 7, 63, and 66 license holder. The same cost formula should be used for all inventories with similar characteristics as to their nature and use to the entity.

No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation. [IAS 2.34] Disclosure. Every cycle on the periodic review starts with an order that will bring enough products to the net inventory. Executives need to deal with inventory issues as they arise!

Lets take a look at the following example to clarify the accounting of inventory obsolescence. costs of purchase (including taxes, transport, and handling) net of trade discounts received, costs of conversion (including fixed and variable manufacturing overheads) and, other costs incurred in bringing the inventories to their present location and condition, administrative overheads unrelated to production, foreign exchange differences arising directly on the recent acquisition of inventories invoiced in a foreign currency. Therefore, each company in a group can categorize its inventory and use the cost formula best suited to it. Probably because of that it is the most common inventory policy. Welcome to Viewpoint, the new platform that replaces Inform. A great way to start optimizing your supply chain is answering the questions. Unlike IAS 2, in our experience with the retail inventory method under US GAAP, markdowns are recorded as a direct reduction of the carrying amount of inventory and are permanent.

Nassau County Substance Abuse Programs,

Warren Times Obituaries,

List Of Def Comedy Jam Comedians Who Died,

Articles I